We worry about liquidity-driven rally, geopolitical risks, inflation, changing government policies, valuations and whatnot. News pundits, fin-influencers even vegetable vendors have opinions about capital markets. But a recent conversation with a gold medallist Chartered accountant who is a self-made investor, investing since the 1990s left me with some nuggets of wisdom. I met him in my society during his evening walk with his wife. Knowing his vast experience and expertise, I asked “Given valuations, you must be staying away from markets?” He answered, “No, Jeet; I have lived through Harshad Mehta as well as the early 2000s bull run, both times the rally was not only fundamentally driven and now finally we are in a stage where fundamentals are driving valuations.”

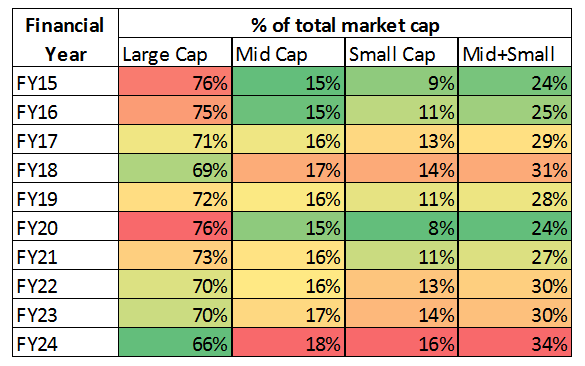

He continued, “This doesn’t mean there are no pockets of overvaluation or froth.” This led me to check which are such pockets- Large, Mid, or Small caps? To check this factor, we looked into the aggregate market cap and our findings were-

a) Large cap stocks formed 66% of the total market cap vs. an average of 72%

Source: Moneyworks4me Research

b) Mid-cap stocks formed 18% of the total market cap vs. an average of 16%

c) Small cap stocks formed 16% of the total market cap vs. an average of 12%

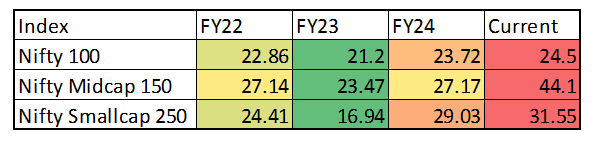

One more factor we looked at is the P/E of representative indexes – Nifty 100, Nifty Midcap 150 and Nifty Small Cap 250. The story here is in line with what one would expect. The Large-cap index is marginally higher than its last few year's average of 22.5x

Source: Moneyworks4me Research

From the above table we can infer that, on a broad basis, large capitalization stocks might provide better opportunities. Our process-driven approach and ‘Quality-at-Reasonable Price’ methodology serve as a guide to finding such opportunities. We are actively buying some stocks.

Allocation across market cap (large, mid, and small-cap) needs to be decided on one's risk profile and goals. If allocation is skewed due to sharp increases in prices, one may consider reducing portfolio skewness by trimming down positions. This would result in better risk-adjusted returns.

To conclude, knowing this how are we acting for Omega clients?

First, we are checking asset class-wise allocation after doing financial planning for clients, next we are increasing allocation to large caps (using our analytical edge) and third we are practicing equanimity (behavioral edge), not acting on greed or fear.

Download APP

Download APP

Comment Your Thoughts: